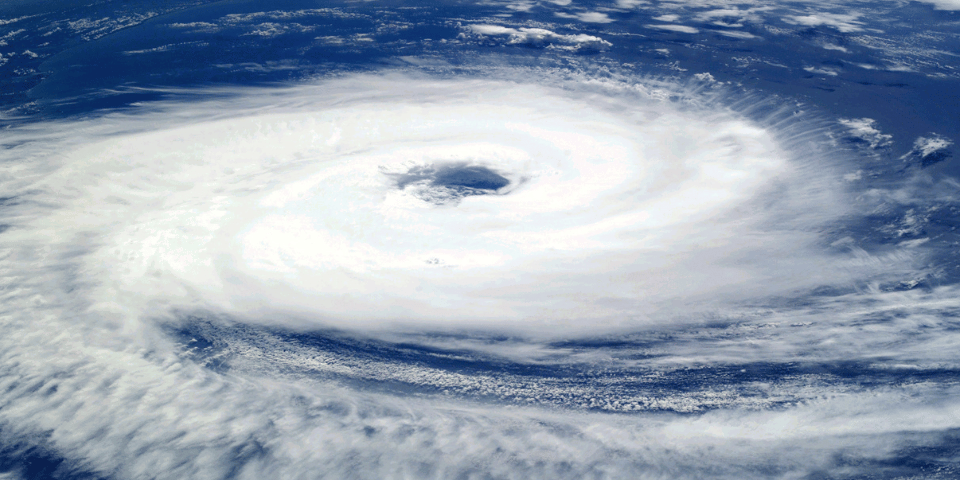

Hurricane Resources

.png?width=1054&height=357&name=hurricane%20page%20(1).png)

Brace for the Worst with the Best

As the hurricane season approaches, we want to ensure that our members are well-prepared. We are here to provide assistance and guidance on how to get started with your preparations.

Start with the Basics:

In preparation for the hurricane season, a good start in preparing is to know where the following important personal items are located:

- Proof of Identification: Driver's license, birth certificate, social security card

- Proof of marital status: Marriage license, child custody papers

- Proof of military service status

- Current insurance policies: Auto and home

Do a Household Inventory Check:

- Not sure where to start? Don't stress. This article explains how to create a home inventory.

- Download this checklist that helps you list all of your household items for potential insurance needs.

- Use an app like Nest Egg Inventory Lite or Home Contents to help you create a home inventory via your smartphone.

Use These Free Supply Lists:

- FEMA Emergency Supply List: Download this checklist to ensure you and your family are prepared with the essentials.

- National Hurricane Survival Initiative Business Survival Checklist: If you are a business owner, download this checklist for recommended emergency supplies to keep at your business.

- Supplies Checklist for Those with Special Healthcare Needs from the Texas A&M Disaster Education Network: If you or someone you know has a disability or has special healthcare needs, download this checklist to ensure you have all the necessary items needed to help prepare for a natural disaster.

Access Your Money During a Mandatory Evacuation:

- Direct Deposit: If you have set up a direct deposit into your Education First account, your funds will be accessible even if you have evacuated. Direct deposit eliminates the possibility of checks being lost, misplaced, or stolen.

- Online Banking: Online Banking allows you to access and manage your funds as long as you are anywhere with an internet connection. Click here to learn more about Online Banking.

- iPay: No need for stamps, envelopes, or trips to the post office. You can pay all your bills in just a few minutes using iPay. To sign up, log into Online Banking and click on the Bill Pay link on the menu located on the left-hand side. All you have to do then is selected who you are paying. Easy Peasy!

- iTalk: If phone systems are functional, you can utilize our iTalk service, formerly called Touch Tone Teller. This is a simple and convenient way to access funds. Call 409.898.7222 or 800.765.3770. Click here for more information about iTalk.

- Debit Card: Use your Education First debit card anywhere that accepts Visa. Since local daily limits could be lowered during a disaster, be sure to have enough cash on hand. With our Card Management feature, you can also limit transactions by amount, type, or geo-location if you are worried about fraud.

- Credit Card: Do not deplete your cash. Emergency expenditures could be more than you anticipate. Click here to apply for an Education First credit card.

- Mobile Banking App: Download the Education First App to access your account through your smartphone. Download the App for iPhone or Android.

- Co-Op Shared Branching Network: Education First belongs to the CO-OP Shared Branching Network, which means you can access your accounts from thousands of locations across the nation, Puerto Rico, Guam, and military bases around the world. Click here to access the Shared Branch Network locations.

Important Preparations for Hurricane Season

Like it or not, another hurricane season is here. Here's your chance to get ahead of the curve by making the necessary preparations now.

Learn More

Top 10 Hurricane Apps

In any disaster, it's incredibly important to be able to reach help - that's where technology can make a big difference.

Learn More