Money Market

Your Money Works for You

A Money Market Checking account offers all the flexibility of a checking account but with higher dividends. If you routinely maintain a higher balance in your checking account, a Money Market Checking may be the right fit for you. It's a great way to make your money work for you!

Account Highlights

It is super-simple (and smart) to open a Money Market account. You will not think twice about this decision in the future - see what is waiting for you!

- No minimum balance requirement

- Dividends earned on balances of $2,000 +

- Zero term commitment

- Convenient access to your funds 24/7 via Online or Mobile Banking.

- No limits on withdraws or checks

- Safe and secure - your funds are federally insured by the National Credit Union Association up to $250,000.

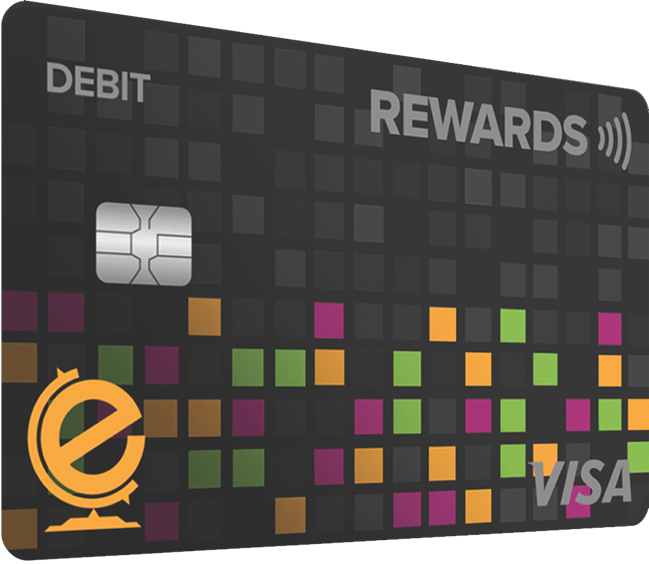

totalREWARDS Visa® Debit Cards

Money Market Checking comes with a totalREWARDS debit card that lets you earn points or cash back* when you spend.

- Get a new card in minutes at any of our convenient locations in Southeast Texas.

- Add your totalREWARDS Visa® to your mobile wallet on your iPhone, Android or Samsung phone for quick and easy payments online or in person.

- Debit card for ATM transactions or for quick and easy in-store purchases.

- Cards are accepted anywhere the logo is displayed.

- Activity alerts, spending limits, and more through convenient Card Management – all from our mobile app.

*Education First credit card purchases earn points automatically. To earn points for purchases made using your totalREWARDS debit card, simply 1) Sign-up for secure eStatement delivery easily via Online Banking, and 2) Have a direct deposit of $500 or more each month into your Education First checking account OR use your debit card for 20 signature based purchases each month. TotalREWARDS Terms and Conditions.

Handy Tools at Your Disposal.

Calculate your budget, see and compare the latest rates and discover what perks you gain for being a member of Education First Federal Credit Union.

Calculate the best loan amount that fits your budget.

Check current rates and find out which ones adhere to your loan type.

When you want a better place to hold your accounts and grow your money, Education First is at the head of the class.