Standard Checking

.png?width=1054&height=357&name=Untitled%20design%20(2).png)

Our Standard Includes Lots of Extras

Education First's "Standard Checking" sets high standards. Unlike other Southeast Texas financial institutions, we don't charge fees for basic services and ATM access. We also pay dividends on checking accounts, a rarity among financial institutions. Our commitment to giving you 24/7 access to your money is unparalleled.

No fees. Dividends that please. Digital access that is a breeze.

Low fees and monthly dividends are just the beginning. Education First's Standard Checking Accounts offer countless ways to access and manage your money. Pay bills online. Use your smartphone to make deposits. Set up overdraft protection.

Account Highlights

It doesn't take much money to open a Standard Checking account. And it costs even less to keep it going.

- Just a $25 minimum opening balance

- No monthly service charge

- Dividends paid monthly on balances of $2,000

- Online banking that offers 24/7 Digital Branch access

- Unlimited check writing and withdraws

- Protect yourself from overdraft charges with Courtesy Pay.

- Enjoy the convenience of direct deposit or payroll deduction into your checking account.

- Federally insured up to $250,000 by the National Credit Union Association.

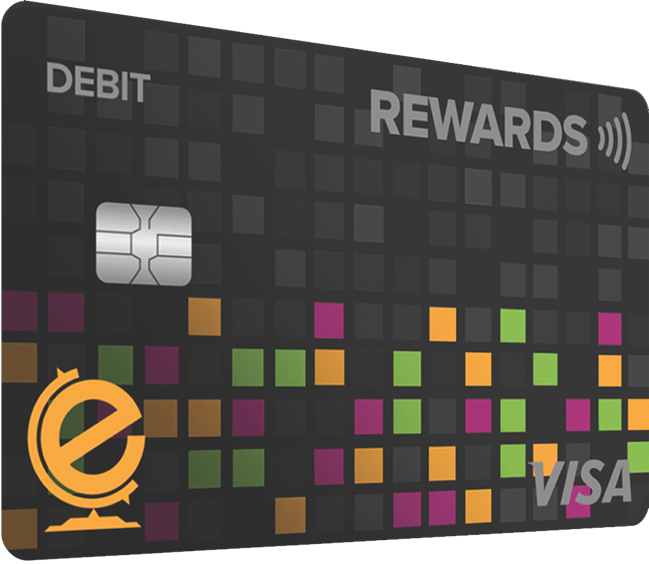

totalREWARDS Debit Cards

Education First's Standard Checking Account comes with a totalREWARDS debit card that lets you earn points or cash back* when you spend.

- Get a new card in minutes at any of our convenient locations in Southeast Texas.

- Add your totalREWARDS Visa® to your mobile wallet on your iPhone, Android or Samsung phone for quick and easy payments online or in person.

- Debit card for ATM transactions or for quick and easy in-store purchases.

- Cards are accepted anywhere the logo is displayed.

- Activity alerts, spending limits, and more through convenient Card Management – all from our mobile app.

*Education First credit card purchases earn points automatically. To earn points for purchases made using your totalREWARDS debit card, simply 1) Sign-up for secure eStatement delivery easily via Online Banking, and 2) Have a direct deposit of $500 or more each month into your Education First checking account OR use your debit card for 20 signature based purchases each month. TotalREWARDS Terms and Conditions.

iThrive

Track your spending by category. Set a savings goal. Create a budget and stick to it. Invest a few minutes of your time on set-up and your finances will thrive.

Learn MoreHandy Tools at Your Disposal.

Calculate your budget, see and compare the latest rates and discover what perks you gain for being a member of Education First Federal Credit Union.

Calculate the best loan amount that fits your budget.

Check current rates and find out which ones adhere to your loan type.

When you want a better place to hold your accounts and grow your money, Education First is at the head of the class.